“Avalara Managed VAT Reporting eases our ability to manage tax returns for eight countries, which means we can focus on growing the business.”

—Josie Stephens

Assistant Accountant, Nodor International

Simplify global VAT and e-invoicing mandates with our integrated solution.

Trusted by businesses across industries

For VAT/GST calculations, access 640+ rates and 130K+ rules supported by Avalara, plus 150+ validation checks and compliant e-invoices for highly accurate VAT reporting.

Catch discrepancies early with automated data validation across Avalara solutions. Improve accuracy, reduce errors, and stay audit-ready.

Get VAT registered, comply with local e-invoicing rules, and file returns in the right language — so your business can grow.

Generate VAT returns across multiple countries with a few clicks. Streamline filing to reduce manual work or outsource the entire process to Avalara.

Navigate evolving Continuous Transaction Control (CTC) regulations. Meet country-specific e-invoicing and live reporting requirements — on time, every time.

Avoid the hassle of managing multiple vendors. Avalara simplifies VAT compliance with a unified approach for tax determination, e-invoicing, and reporting.

Get a complete view of your VAT transactions with Avalara VAT Reporting. Integrated with Avalara E-Invoicing and Live Reporting, it tracks e-invoicing and standard billing transactions — all in one place for better compliance.

Avalara helps businesses take on complex VAT requirements and manage determination, e-invoicing, and reporting more efficiently.

Use one provider for global VAT so you no longer need multiple tax providers.

Help ensure more accurate tax calculations for every transaction.

Maintain ongoing compliance with global e-invoicing and live reporting mandates via one unified, easily adaptable system.

Manage filings yourself with Avalara VAT Reporting or let Avalara experts handle it for you with Avalara Managed VAT Reporting.

“Avalara Managed VAT Reporting eases our ability to manage tax returns for eight countries, which means we can focus on growing the business.”

—Josie Stephens

Assistant Accountant, Nodor International

“Keeping up to date with the continual changes in the rules ... in each territory is a challenge.”

—Jos Verheijen

Indirect Tax Manager, NSE Products Europe

“Filing VAT returns in multiple jurisdictions would be quite time-consuming. My time is much better spent doing more strategic work than on keeping track of our VAT submissions.”

—Metka Koskas

Financial Controller, Missoma

“Using Avalara gives us the reassurance that all our VAT returns will be filed on time. We don’t need to worry about the different deadlines, different attitudes of local tax offices, different languages or requirements in each country, or translating tax notices, to ensure we are compliant.”

—Mag. Mitat Gürkan

International Accounting Manager, Glamira

Apply highly accurate, regularly updated tax rates based on location, taxability, legislation, and more.

Register for VAT in over 50 countries, with an easy-to-manage process workflow.

Comply with global e-invoicing requirements and automate your finance processes.

Generate highly accurate returns with 150+ data checks to help ensure error-free reporting.

Calculate and estimate real-time customs duties and import taxes at checkout.

If you do business within the U.S., outsource sales and use tax preparation, filing and remittance, and notice management to Avalara experts.

Want to learn more about global VAT requirements? We have resources to get you started.

EXPLORE

IMPLEMENT

USE

Avalara VAT compliance solutions provide an end-to-end process to manage VAT obligations. By determining VAT rates, generating e-invoices in requested formats, and filing VAT returns, our solutions help businesses streamline compliance and reduce risk.

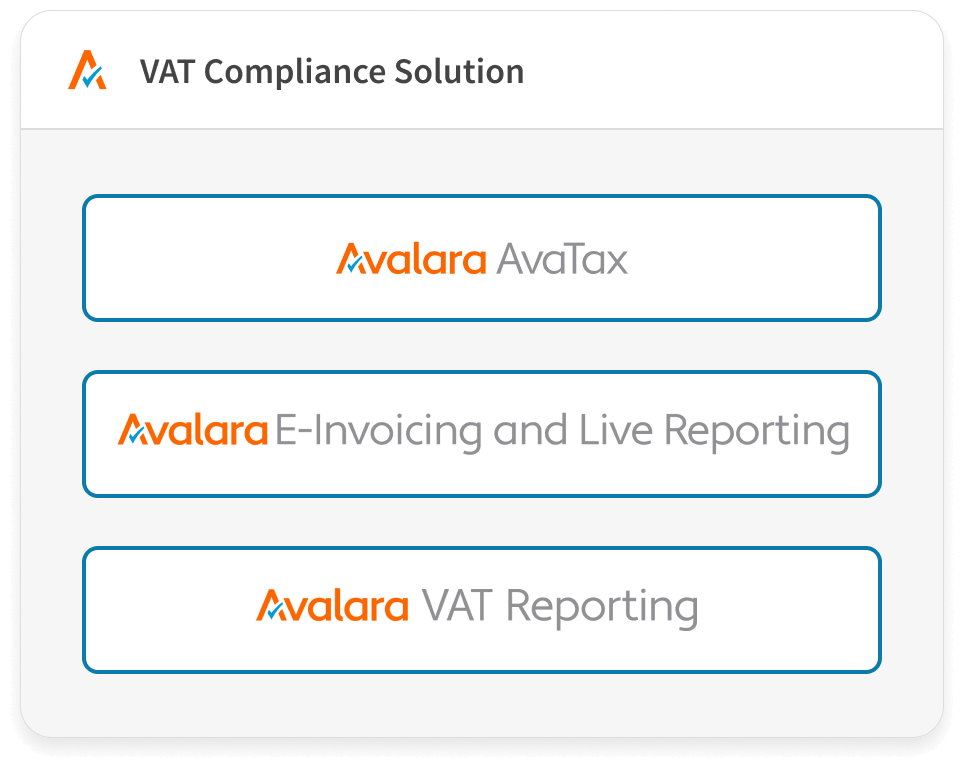

The Avalara VAT compliance suite includes Avalara AvaTax for VAT determination, Avalara E-Invoicing and Live Reporting for complying with real-time reporting mandates, and Avalara VAT Reporting and Avalara Managed VAT Reporting for VAT return generation and filing.

Yes. Our solutions are designed for businesses operating across borders, supporting VAT compliance in multiple jurisdictions with features like multilingual reporting and local filing formats.

Managed VAT Reporting is a service that allows you to offload the VAT compliance burden to Avalara experts. We handle everything from filing VAT returns to managing discrepancies, so you can focus on growing your business.

Avalara E-Invoicing and Live Reporting automatically converts invoice data from your ERP or other business system into the required e-invoicing formats for direct delivery to tax authority platforms across various countries via prebuilt integrations.

Avalara solutions integrate seamlessly with popular ERP, ecommerce, and accounting platforms, making it easy to automate VAT compliance within your existing workflows.

Avalara Cross-Border automates the assignment of HS, HTS, and Schedule B Codes (Tariff and HS Code Classifications) and calculates customs duties and import taxes in real time (AvaTax Cross-Border). You can use the solutions on their own or together to increase international compliance, enhance business margins, and provide customers a superior Delivered Duty Paid (DDP) buyer experience to reduce risk of cart abandonment.